+ 1

trillion pesos

market cap on November 1 st, 2019

88

%

of our stores

are supplied with renewable energy

1

.

5

billion pesos

channeled through social impact programs

Finance Value

2019 was a year of transformation, of investment, and results. We focused on building an

even more customer-centric business, better positioned for the future, while delivering

solid results within a very challenging macroeconomic environment.

We were able to leverage our capabilities inside and

outside the store. We surpassed the number of stores

opened in the last five years and continued to accelerate

growth in eCommerce sales.

We continue creating value for all of our stakeholders.

The Walmart of the Future is happening today.

Olga González

Senior Vice President and Chief Financial Officer

Walmart de México y Centroamérica

Walmart de México y Centroamérica

MESSAGE

Performance

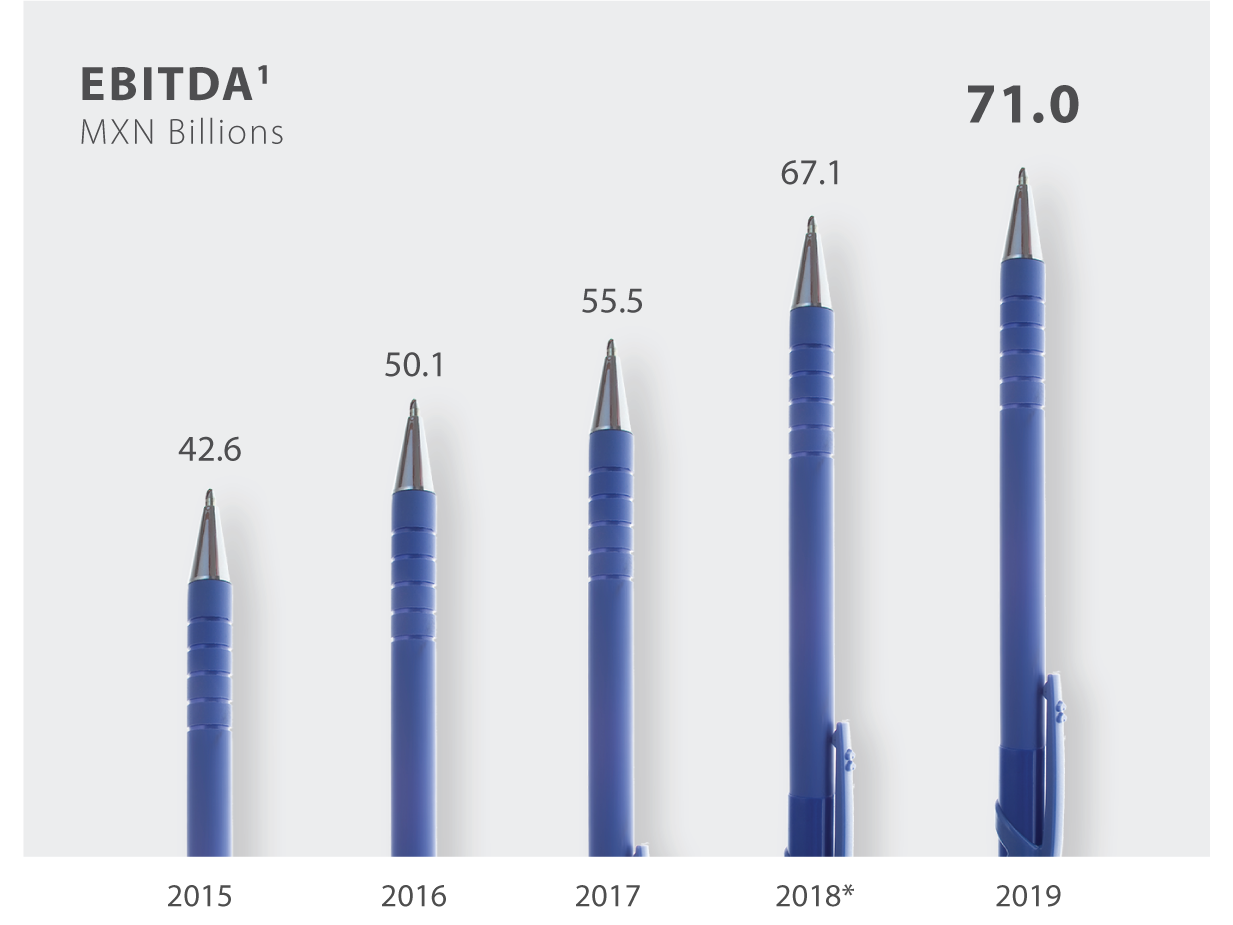

In 2019, we achieved solid results and continued to grow steadily and profitably in sales and EBITDA.

We invested in expanding our omnichannel coverage, eCommerce, technology, salaries, and logistics

to meet our customers’ new purchasing habits and preferences. We manage our stores and clubs

with discipline, the efficiencies achieved have helped us to generate the necessary resources to keep

driving future growth and increase profitability.

Growth by country, format and division

In Mexico, all regions and formats delivered a positive performance. The North and

South regions had the highest same-stores sales growth, followed by the Center and

Metro regions, which delivered softer growth due to the competitive dynamics and

macro conditions in those regions.

Same-store

sales grownth

sales grownth

Mexico

4

.

4

%

Central America

0.

4

%

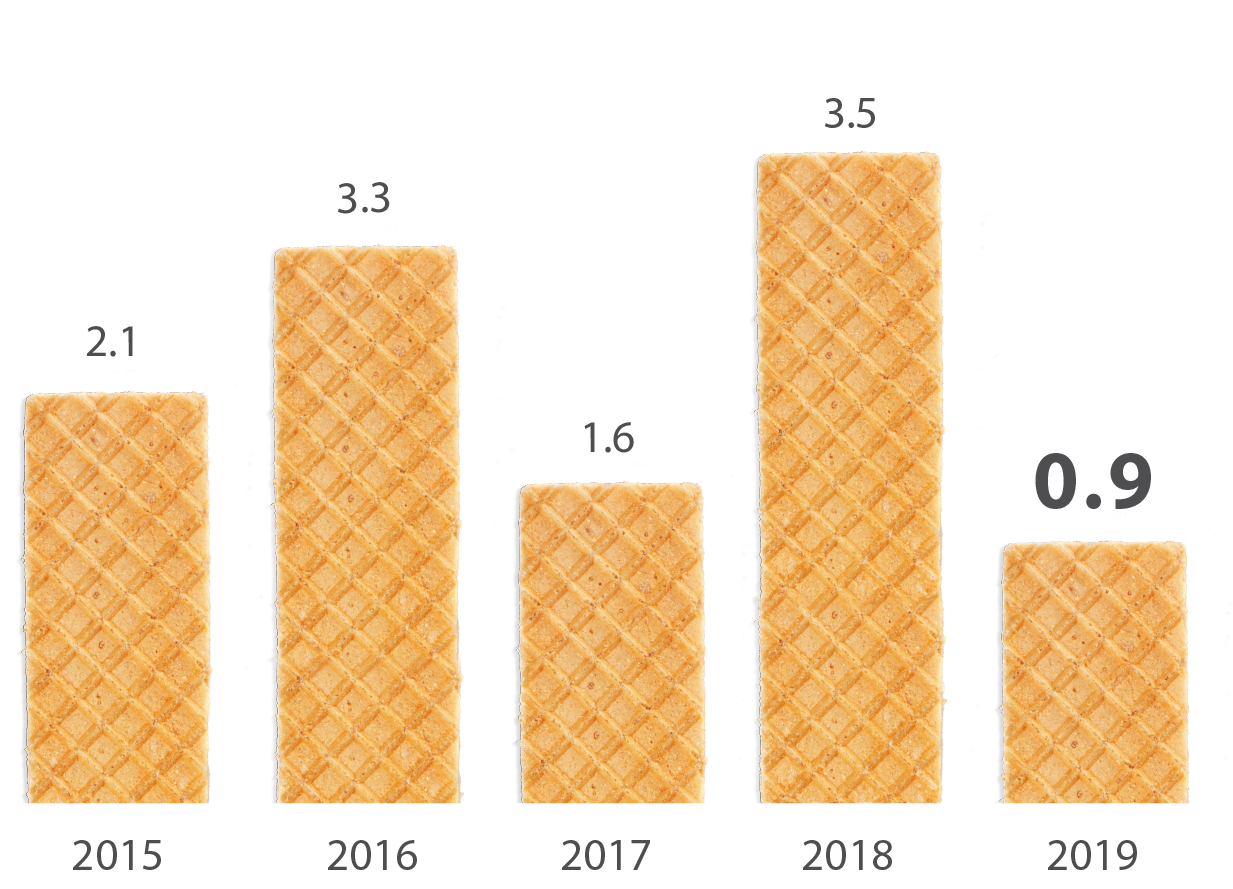

Differential growth in same-store sales Walmex 1 vs ANTAD Self-service and Clubs 2

Percentage points

In 2019, we surpassed ANTAD’s self-service and clubs same-stores sales

growth by 90 basis points. With this, we have been able to accumulate five-year

higher growth at same-stores than our direct competitors.

1 Self-service and Sam’s Club

2 Excluding Walmex

In Mexico

Total revenue was 532.2 billion pesos, which represented a 5.7% growth compared to

2018. All formats and regions grew, our largest division, Food and Consumables, grew

the fastest.

We continue to accelerate our eCommerce business growth; in 2019 GMV’s sales rose by

61%3, reflecting the fact that our omnichannel offer is gaining momentum. A 52% online

net sales annual growth was reached, this figure is higher than the 40% growth of 2018

and shows the correct execution of our digital transformation strategy along with efficient

investments made in logistics network. eCommerce sales represented 1.5% of total sales and

contributed 50 basis points to total sales growth.

To strengthen our leadership in the market and increase customer transactions, we invested

in pricing and widened the price gap with the competition by 20 basis points. These

commercial efforts reduced the gross margin by 10 basis points, which this year represented

22.6% of total revenue.

SG&A for the year grew 3.5%, 220 basis points below revenue growth, as a result of our

efforts in productivity and operating efficiencies.

Thanks to sales growth, good margin management to maintain competitiveness, along with

disciplined expense control, operating income grew 8.3% and represented 8.9% of total

revenue, and EBITDA grew 8.6%, representing 11.4% of revenue.

3 eCommerce GMV’s growth mentioned above excludes call center sales.

Note: Last year references are based on the pro-forma 2018 figures adjusted due to the adoption of the IFRS 164.

Note: Last year references are based on the pro-forma 2018 figures adjusted due to the adoption of the IFRS 164.

114

.

6

billion pesos

in Central America of total

revenue +3.4% vs 2018

revenue +3.4% vs 2018

In Central America

Total revenue reached 114.6 billion pesos

increasing 3.4% over the previous year, on a

constant currency basis. Looking at performance

by country, Honduras had the highest growth,

followed by Nicaragua and El Salvador. The

lowest sales performance was in Costa Rica

and Guatemala, reflecting the unfavorable

macroeconomic dynamics in those countries.

Gross margin remained at 24.2%, as the team

achieved the right balance of maintaining price

leadership without compromising profitability.

Expenses increased 10.8%, impacted by the

new intellectual property royalties’ agreement

between our Central American subsidiaries and

Walmart Inc. The agreement came into force

in 2019, but the annual charge was recorded

in the fourth quarter, affecting expenses in 1.6

billion pesos. Excluding this impact from the

annual result, expenses would have grown 2.6%,

achieving a leverage of 10 basis points.

Operating income represented 5.8% of total

revenue. Without the effect of royalties, it

would have been 7.1%, an increase of 20 basis

points and a 7.1% growth compared to 2018.

EBITDA represented 9.1% of total revenue.

Excluding the effect of royalties, it would be

10.5%, with an increase of 50 basis points and a

7.8% growth compared to 2018.

114

.

6

billion pesos

in Central America of total

revenue +3.4% vs 2018

revenue +3.4% vs 2018

646

.

8

billion pesos

at a consolidated level total

revenue +4.9% vs 2018

revenue +4.9% vs 2018

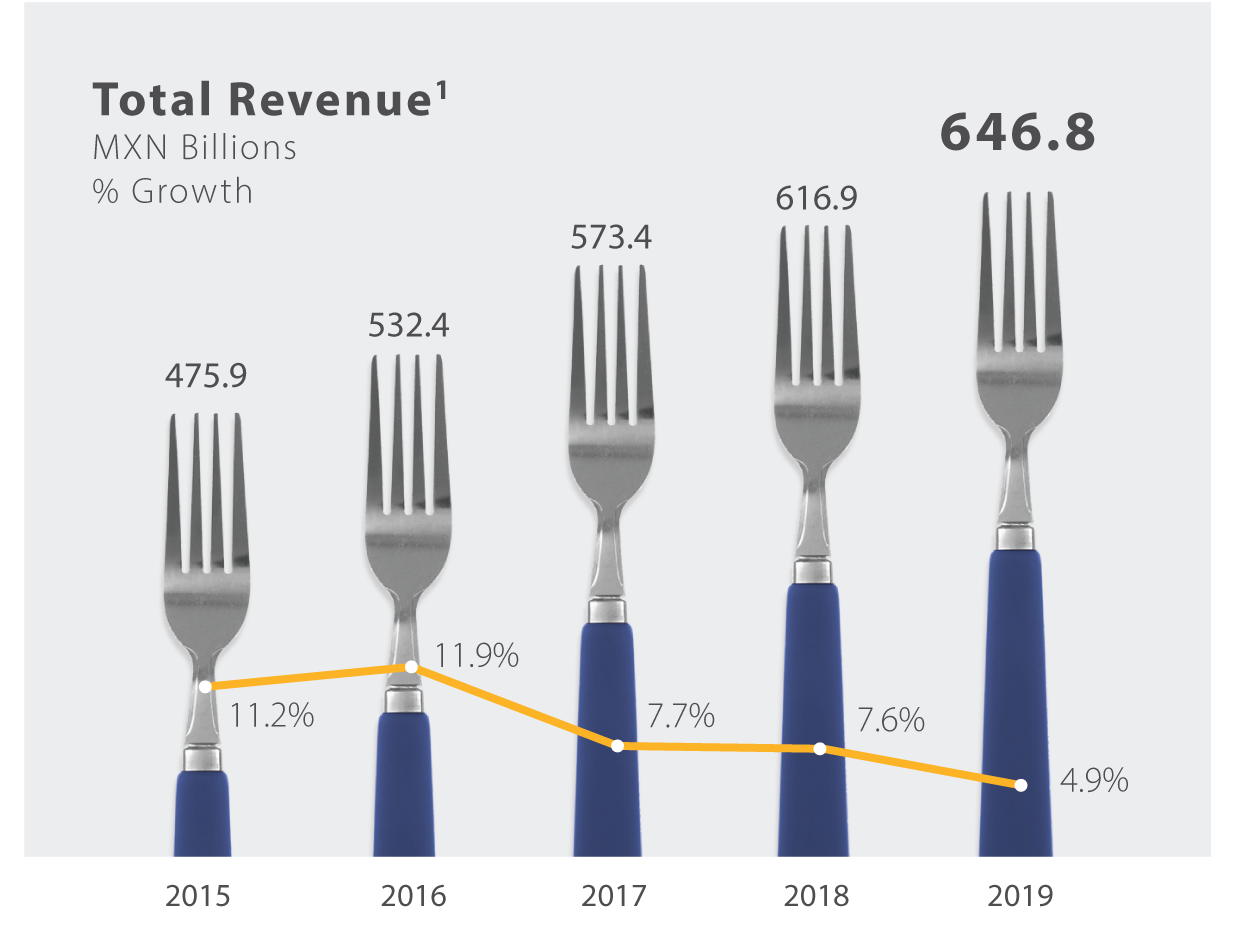

Consolidated figures

Consolidated revenue reached 646.8 billion

pesos and increased 4.9% compared to 2018.

Gross margin of 22.9% was reduced by 10 basis

points mainly due to our continued commitment

to price investment.

Expenses grew 4.6% compared to 2018, without

considering the effect of Central American

royalties, growth would be 2.9%, with which we

leveraged the expense in 20 basis points. The

latter was achieved by exercising an excellent

display of discipline in expense control in both

regions.

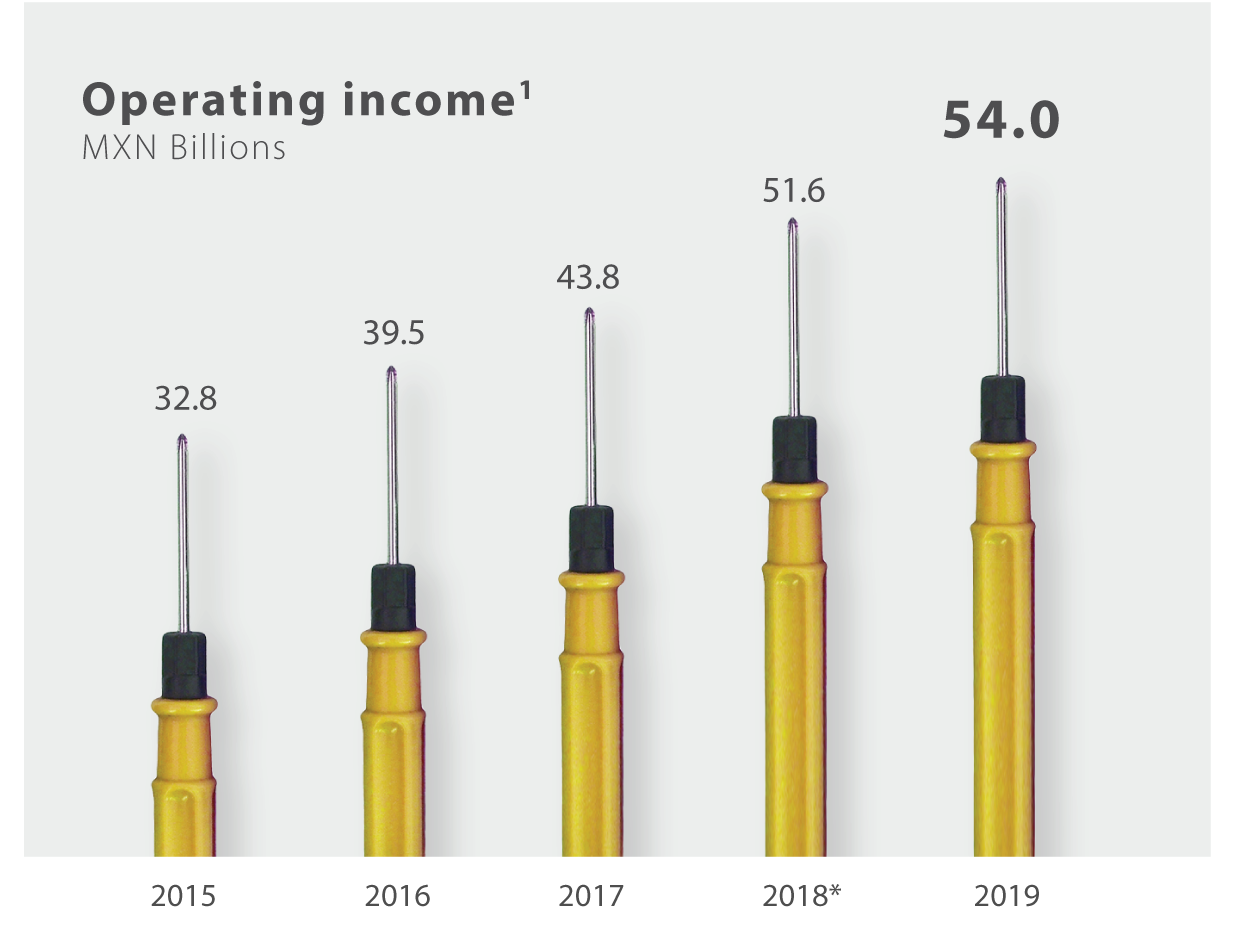

Operating income represented 8.3% of total

revenue. Excluding the effect of royalties, it

would represent 8.6% with an increase of 20

basis points and a 7.8% growth over the previous

year. EBITDA reached 71.0 billion pesos, 11.0%

of total revenue. Without considering the effect

of royalties, it would be 72.6 billion pesos and a

11.2% margin, with an increase of 30 basis points

and an 8.1% growth compared to 2018.

646

.

8

billion pesos

at a consolidated level total

revenue +4.9% vs 2018

revenue +4.9% vs 2018

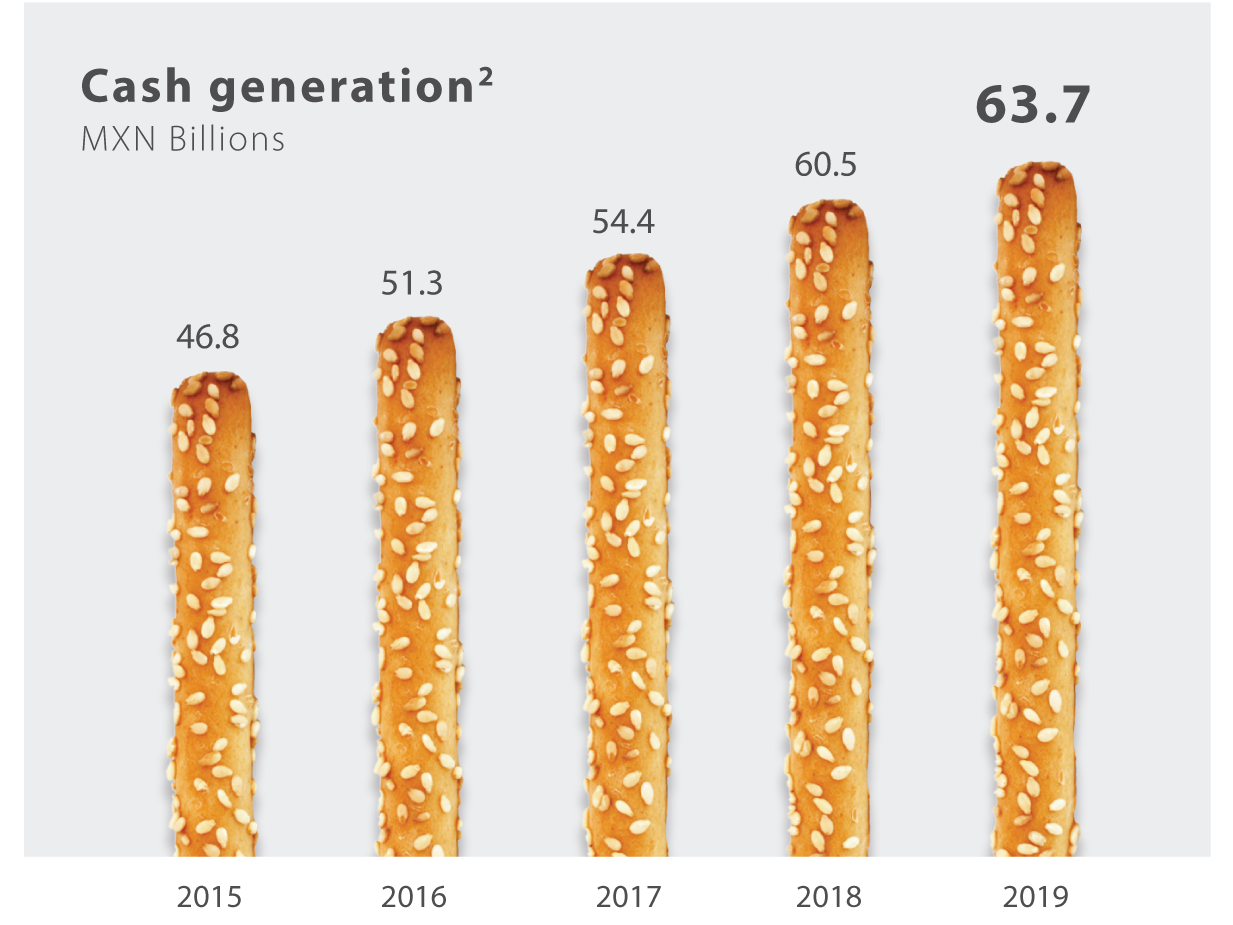

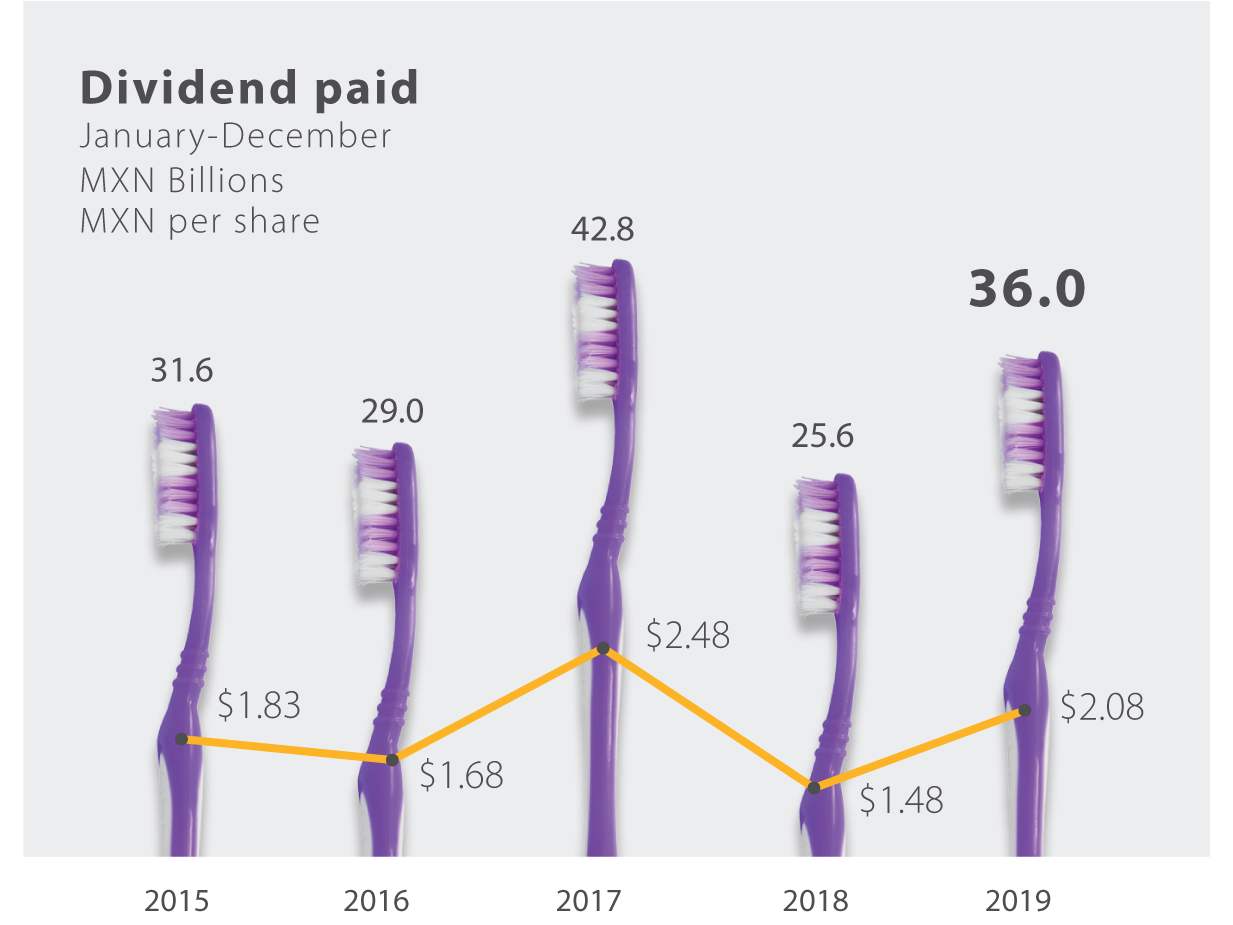

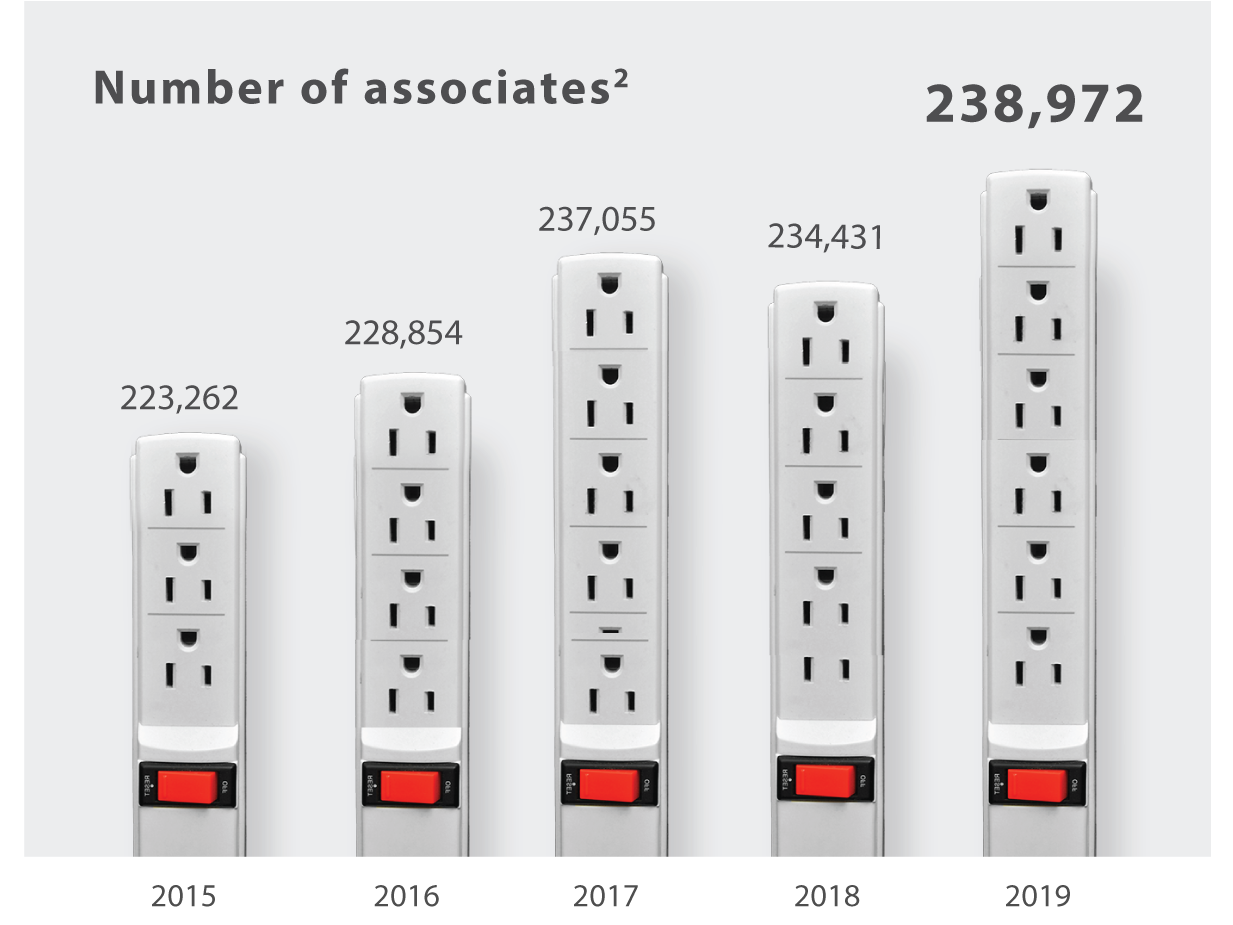

Key performance

indicators

Supported by strong

cash flow generation,

operating with

quality and financial

discipline, we keep

investing to continue

our leadership in

the future.

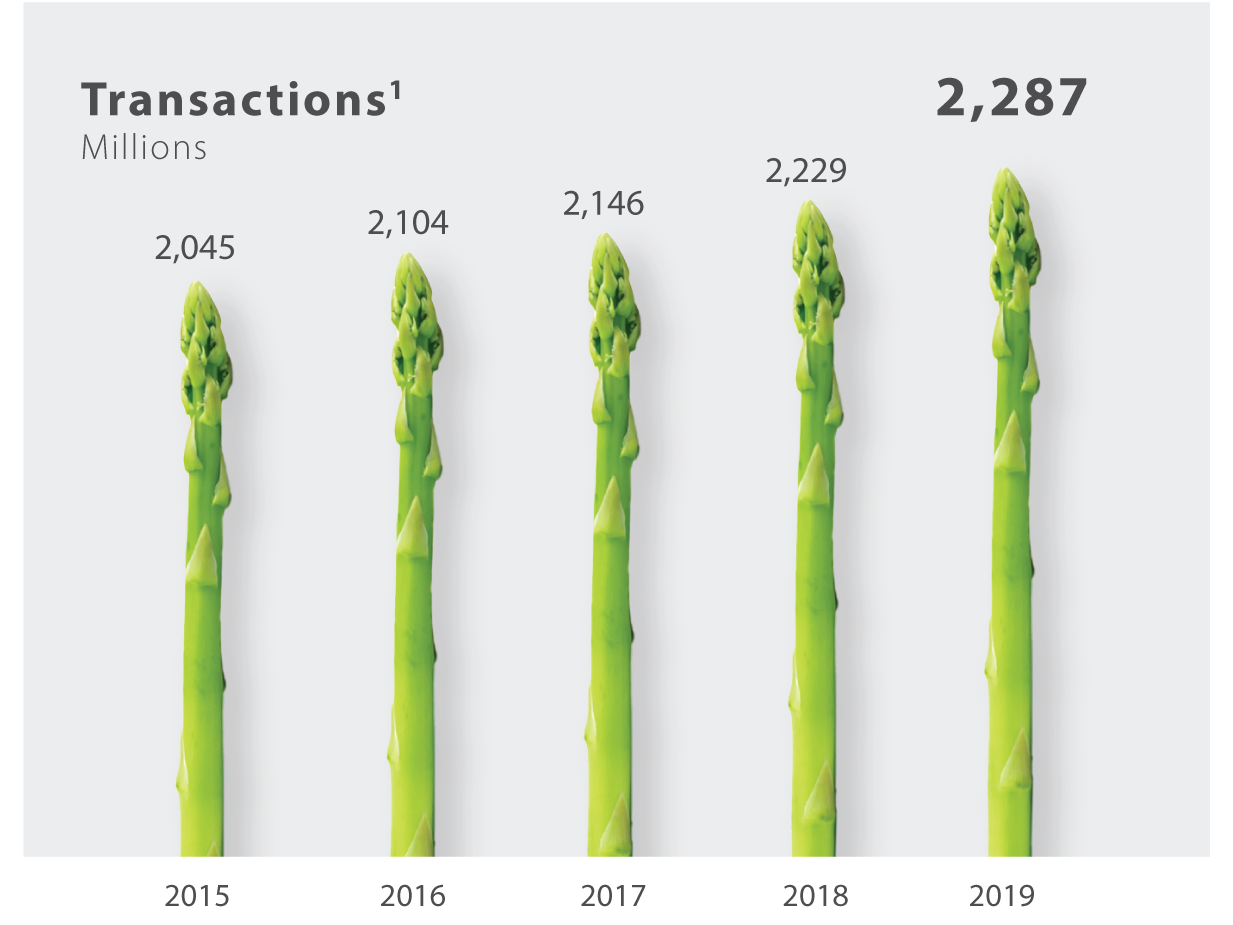

Transactions

Transactions

Total Revenue

Total Revenue

Operating income

Operating income

EBIDTA

EBIDTA

Investment in fixed assets

Investment in fixed assets

Cash generation

Cash generation

Dividend paid

Dividend paid

Number of associates

Number of associates

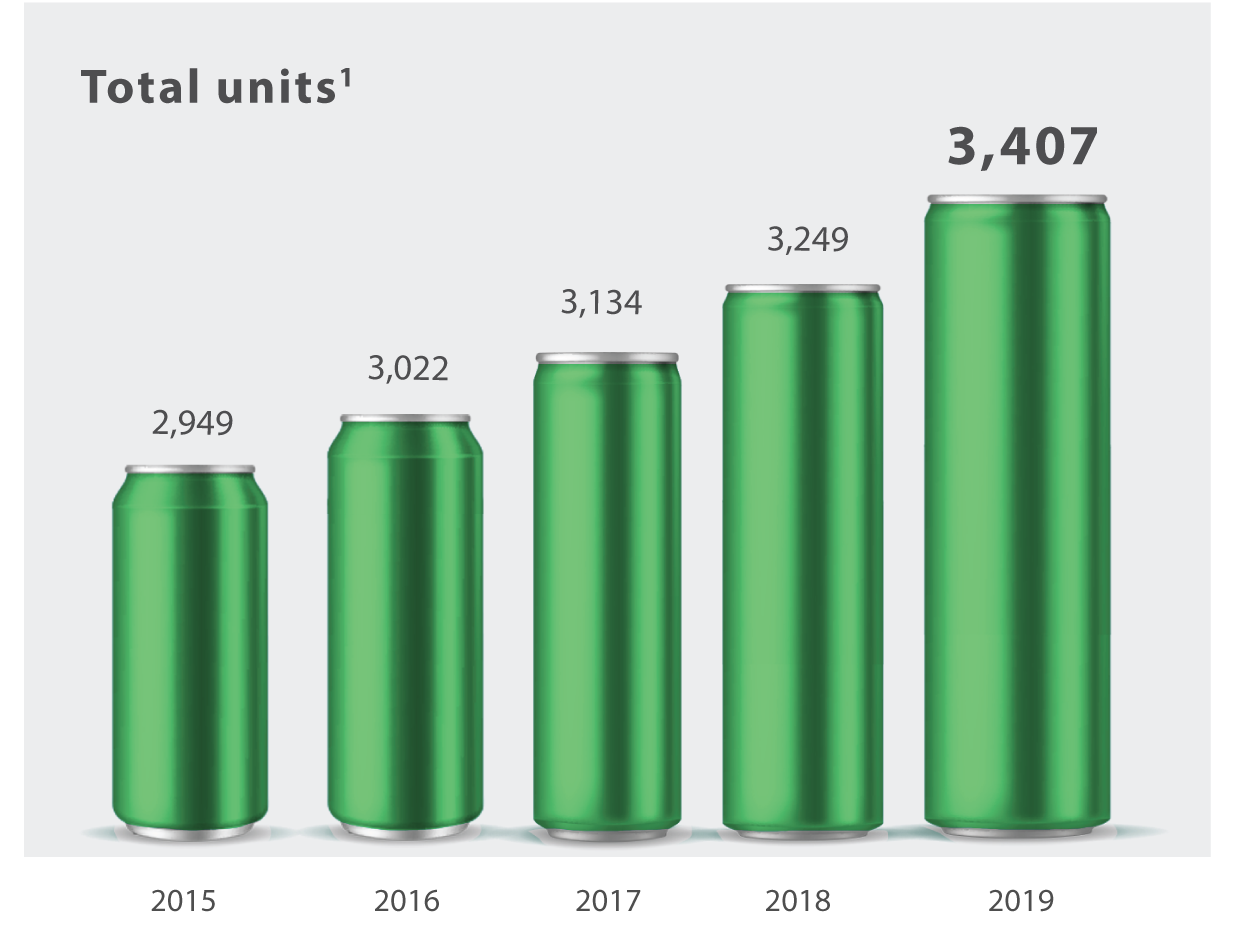

Total Units

Total Units

1 Walmex excluding Banco Walmart

and Suburbia.

2 Excluding Suburbia since 2016.

* Last year references are based on the pro-forma 2018 figures adjusted due to the adoption of the IFRS 164.

1 Walmex excluding Banco Walmart

and Suburbia.

2 Excluding Suburbia since 2016.

* Last year references are based on the pro-forma 2018 figures adjusted due to the adoption of the IFRS 164.

Value for Shareholders

Our stock reached a historical high

of 59.04 pesos this year, as a sign

of confidence in our operation,

financial strength, and efficient

use of assets. We are building

the Walmart of the future from a

position of strength.

We consistently reward the trust of

our shareholders. This year, we paid

35.96 billion pesos in dividends,

which include the fourth payment

decreed in 2018 for 0.33 pesos

per share, 0.19 pesos for ordinary

dividend, and 0.14 pesos for

extraordinary dividend, plus 1.75

pesos per share, corresponding

to the payment decreed in 2019,

which is composed of an ordinary

dividend of 0.84 pesos per share

and an extraordinary dividend of

0.91 pesos per share, both paid in

three installments, the ordinary

dividend of 0.28 pesos per share, in

April, August, and November 2019

and extraordinary dividend of 0.35

pesos per share in April, 0.30 in

August, and 0.26 in November 2019.

Investments

We balanced the short and long-term investments,

allocating resources to our low-price proposal and

salaries, while, with a long-term perspective, we

built the infrastructure and capacities that will allow

us to continue on the road to success. We invested

20.58 billion pesos in capital expenses during the

year, of which we allocated 40% to maintaining

and remodeling existing stores, 28% to new stores

openings, 20% to the logistics network, 11% to

eCommerce and technology, and 1% to the fresh

upstreaming projects.

We opened two distribution centers in Mexico

dedicated to eCommerce in Monterrey and

Guadalajara, with an investment of 370 million

pesos, significantly improving delivery in 17 states

of the country. In Costa Rica, we expanded the Coyol

distribution center, making it the largest in Central

America.

We surpassed the number of new stores opened

in the last five years, opening 161 units in 2019,

134 in Mexico, and 27 in Central America. The new

stores added more than 1.7 million ft2 of sales floor,

contributing 1.7% to sales growth and 2.1% to the

increase in installed capacity.

We continue to make our investments more efficient

in order to adjust our value proposal to different

markets. We opened new prototype stores with the

same customer value proposition with only a few

changes in assortment and store size to adapt it to

the market where it is located.

With a long-term perspective, we built the

infrastructure and capacities that will allow us to

continue on the road to success.

76

,

414

,

319

ft2

added to sales floor

Source: Map data ©2019 Google

This year, we opened the Mi Bodega Hercules

store, located in a mining region on the border

of Coahuila and Chihuahua.

Our transformation also emphasizes inclusion.

This year, we opened five inclusive stores,

which offer greater autonomy to our customers

and associates with disabilities. Walmart Punta

Guadiana in Durango, was the first inclusive

store we opened, which has help buttons,

preferential points of entry, accessible furniture,

and tactile guides.

Through our philosophy of everyday low price

and productivity, we continue to strategically

manage capital to deliver value to our

shareholders and all our stakeholders.

2019 was a year of results, transformation, and

challenges, and we continue to generate new

opportunities to maintain our strength in the

future.

We used our scale in a positive way, being careful to

generate returns on capital and to make a positive

contribution in the communities where we serve.

Income Statement and Balance Sheet

At December 31, 2019 (MXN Billions)

Consolidated Results Walmex 2019

4 In order to provide the investors community a better view of the underlying performance of our business, we are including a retroactive estimation of the effect the adoption of the IFRS 16 would have had on 2018 financial results. These pro-forma 2018 figures are not audited, but are based on the 2018 audited reported results and adjusted with our best estimates to show the effects related to the adoption of the IFRS 16. Please note that all the references that will be done to last year’s results are based on 2018 pro-forma figures.