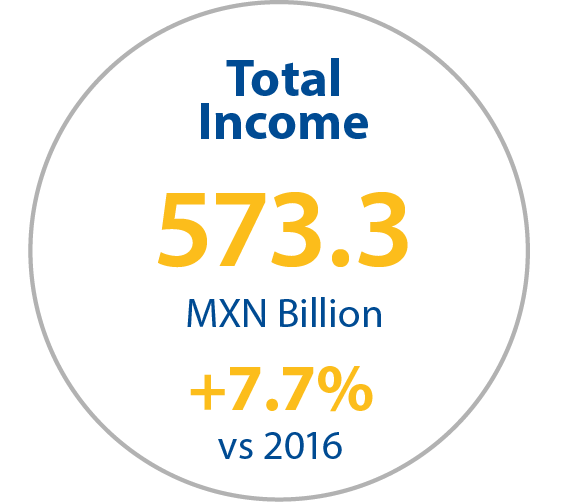

Our sound and consistent sales performance during 2017 has generated 7.7% growth in total consolidated income, equivalent to $573.3 billion pesos.

We expanded our margins by 20 basis points, from 22.1% to 22.3%, a reflexion of the right execution of our cost efficiency initiatives, without undermining the achieved price gap that maintains market competitiveness.

Our expenses have been kept at the same level as last year, that is, 14.6% as a percentage of total income, growing below sales. This has been possible thanks to the operating efficiencies that freed up resources for investments needed to continue modernizing our store base, and making it possible to open a greater number of new units and broadening our technological capacities.

As a result of solid sales and disciplined expense controls, our operating income reached $43.8 billion pesos, a 20-basis point expansion as a percentage of income, and 11.1% above amounts reported for 2016.

Likewise, our EBITDA amounted to $55.5 billion pesos, which is a solid 10.6% increase over the previous year, and a 30-basis point expansion as a percentage of income.

We set aside $17.4 billion pesos for investment in fixed assets, thus enabling us to continue with our program to open new stores, broaden our logistics network, modernize our technological platform, and remodel our base of existing units, all with the purpose of responding to new trends and market needs.

This year we opened 125 new stores in Mexico and in Central America, thus contributing 1,884,023 additional square feet to the existing sales floor, and 2.2 percentage points to consolidated sales growth.

We are grateful to the trust placed in us by our shareholders –through the constant payment of dividends- which in 2017 reached a record number of $42.8 billion pesos, that is, 2.48 pesos per share. Said expenditure was as follows: 0.14 pesos per share corresponding to the remaining ordinary dividend decreed in 2016 and paid this year; 0.64 pesos per share as an ordinary dividend decreed this year, of which 0.16 pesos per share shall be paid in 2018; and 1.86 pesos per share as extraordinary dividend decreed and paid in 2017, which includes 0.96 pesos per share as extraordinary dividend stemming from the sale of Suburbia.

The Company balance sheet closed the year with $35.6 billion pesos in cash, some 27.2% above those levels posted for 2016, as a result of solid sales, expense controls, and improvements in working capital.

The financial strength and discipline that characterize our Company allow us to continue generating the resources needed for our operations, but always with a long-term view and with consistently investing in the business, enabling us to take our value proposition to more customers throughout Mexico and Central America. This year our cash generation totaled $54.4 billion pesos, proof of our solid and sustained growth.

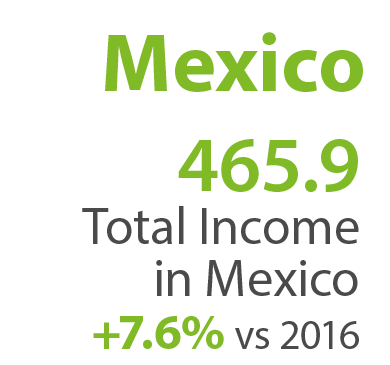

Mexico

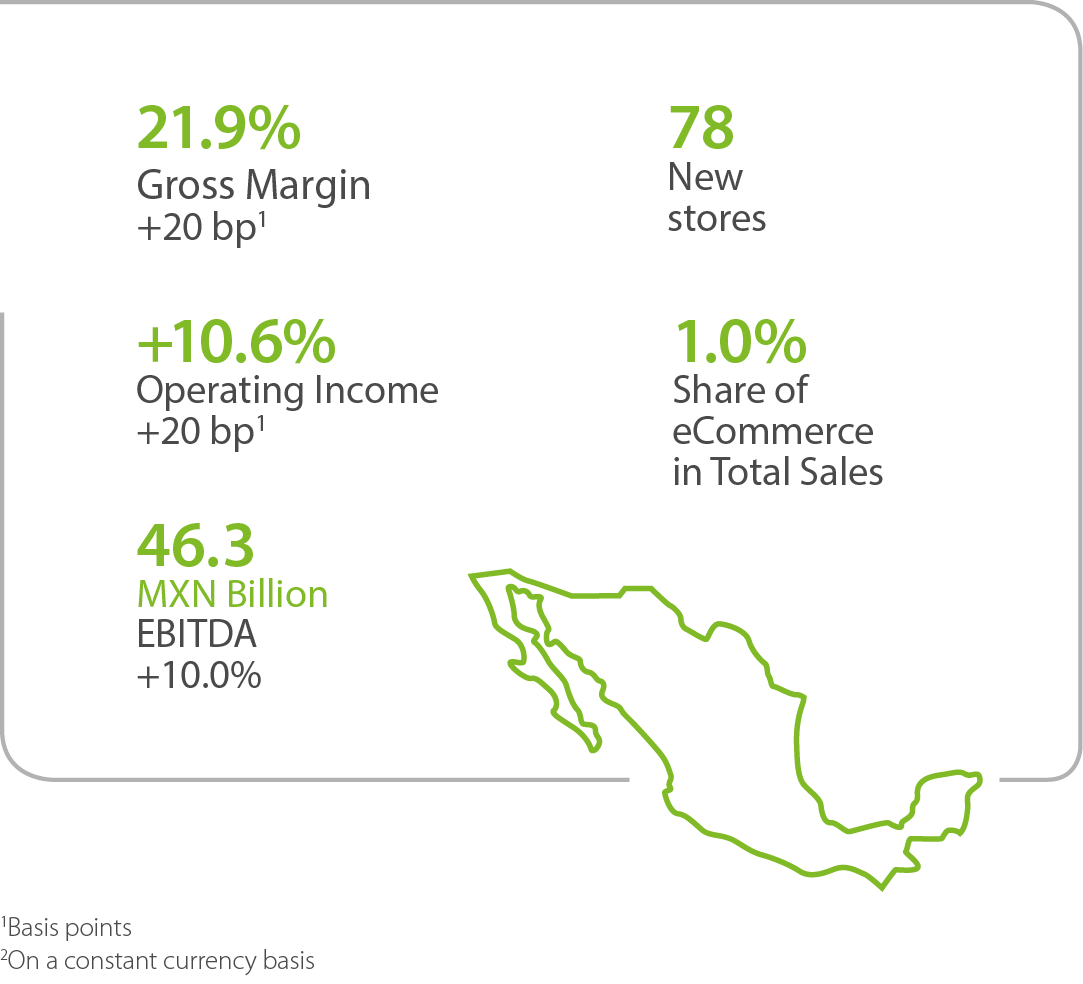

Total income in Mexico reported 7.6% growth over the previous year, amounting to $465.9 billion pesos as a result of good sales performance in all our business formats, merchandise divisions, and regions throughout the country. In parallel, our ecommerce business represented 1.0% of total sales and contributed with 0.3 percentage points in sales growth.

Our gross margin grew 20 basis points as a percentage of income, going from 21.7% to 21.9%, thanks to operational initiatives and certain reclassifications.

As a result of consistently applying productivity measures, the percentage of expenses over total income dropped 10 basis points, despite investments made to respond to market and future needs.

Stemming from the above, operating income levels grew 10.6%, and reached 8.0% as a percentage of income, representing 20 basis points in growth over figures reported for 2016.

Moreover, EBITDA –equivalent to $46.3 billion pesos- grew 10% over the previous year, which represents 20 basis points in increase as a percentage of income, that is, from 9.7% to 9.9%.

Installed capacity throughout Mexico increased 1,413,485 square feet with the opening of 78 new units, which in turn contributed 1.3 percentage points to consolidated sales growth.

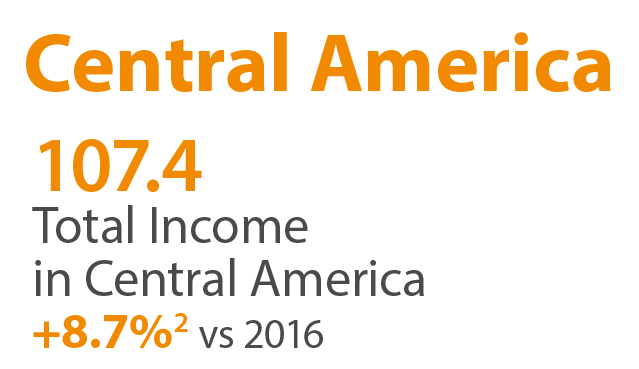

Central America

Total income for Central America amounted to $107.4 billion pesos, 19% of total consolidated income for the Company, as well as 8.1% and 8.7% growth over last year, on a constant currency basis. This is the result of solid sales performance in all countries and all the formats, supported by improvements in price gaps, increased reinforcement of key business categories, and store opening rates that surpassed established goals.

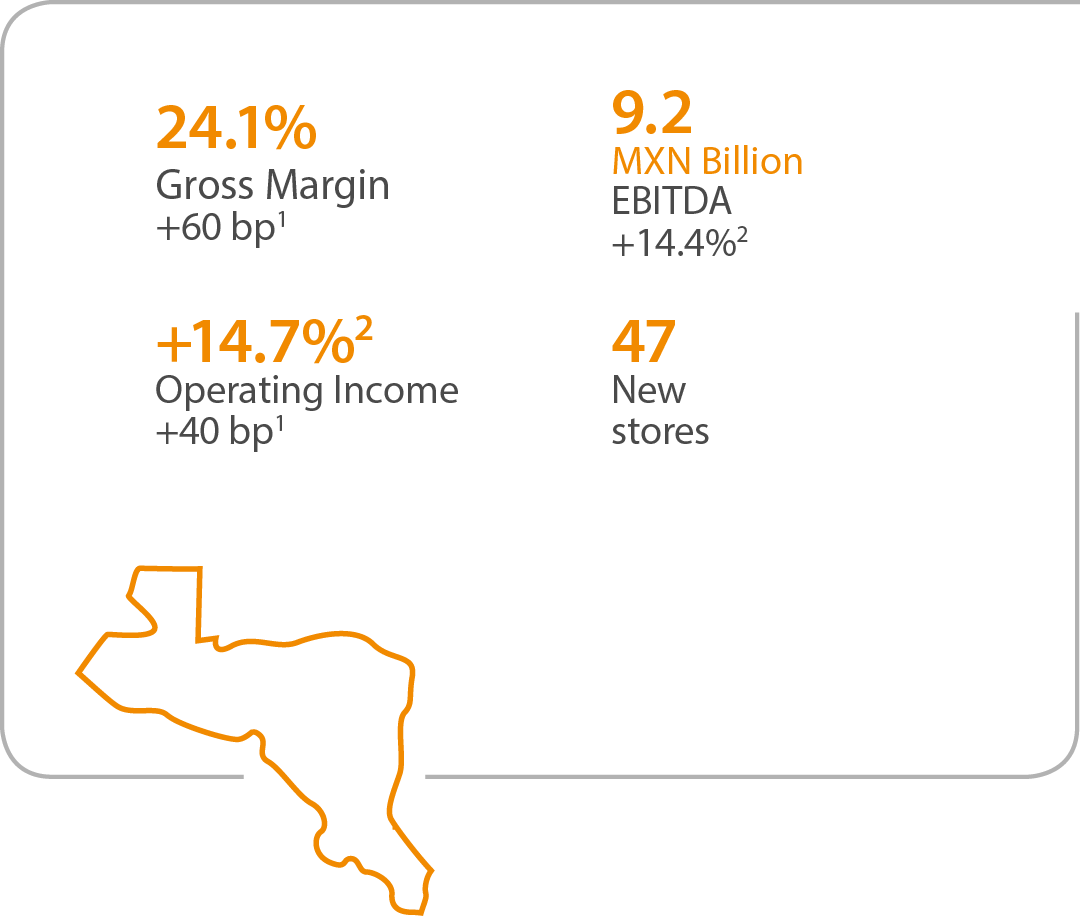

Similar to achievements made in Mexico, in Central America we were able to expand our margins from 23.5% to 24.1% as a percentage of total income, resulting from operation improvements, especially in the agro-industry division.

General expenses grew 20 basis points over 2016, due to the costs generated with the opening of a greater number of units throughout the year, and investments made to improve existing stores.

GAs a consequence of consistent sales growth and properly managing margins, operating income posted 40 basis points in growth -from 5.8% to 6.2%- as a percentage in total income; EBITDA amounted to $9.2 billion pesos -growing from 13.7% to 14.4%- without exchange rate considerations, and 8.5% regarding income.

The aforementioned accelerated rate of expansion is reflected in the 47 new stores opened in the region, which contributed an additional 470,537 square feet in sales floor, and 0.9 percentage points to consolidated sales growth.